Do you feel that the company you work for or manage is often trailing staffing needs? That you often are desperately looking for candidates at the last moment and have to settle on new hires rather than excitedly bringing in a “true” A-Player? Do you feel your company’s work quality suffers as a result, and that you have to deal with more project errors as a result? That your collaboration with some of your colleagues is down, and as a result of all the issues, your stress is up? Chances are, you probably aren’t alone.

The solution to better hiring is often difficult, not because it is complicated, but rather it takes effort and practice — and lots of it. Chances are the company you work for or manage doesn’t do it. In many instances, it may take wholescale change, including being more proactive and dedicating resources (budget, time and people). Wholescale revision of the planning stages, recruiting activities and interview processes may be needed. With a labor market that is shrinking, all-star employees becoming more valuable and clients becoming more demanding, can you really afford not to do this?

Calculating costs

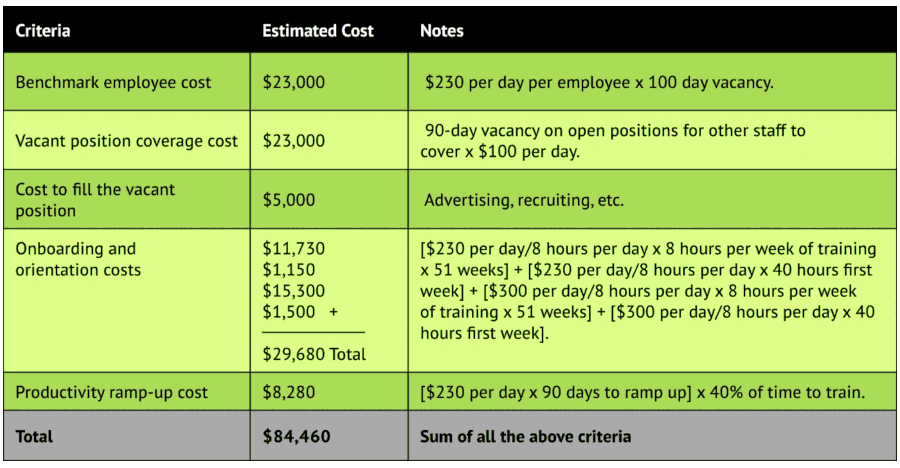

First the justification: For every role you don’t fill (especially after an employee leaves), you can calculate the employee fill (or turnover) cost based on the following criteria [A]:

-

Benchmark employee cost — the total departed/un-hired employee’s compensation (salary and benefits). You can break this data into daily and monthly rates to accurately prorate across the time the position remains open.

-

Vacant position coverage cost — the number of days the position remains empty multiplied by the daily rate provided in your benchmark costs. This is essentially how much it is costing your company to cover the position. And, since it is likely being covered by other resources, this cost is caused by offsetting other priorities that are likely getting sidelined to fill the void, and/or the induced stress it is causing your staff, which in turn, could lead to increased turnover.

-

Cost to fill the vacant position — the total cost associated with all talent acquisition, including advertising, screening and selection. This includes the consideration for the HR and/or hiring manager’s salary, advertising costs, assessments, testing, and/or background checks and the cost of all time spent by employees involved in the interviewing process.

-

Onboarding and orientation costs — the cost of all time spent by a trainer and/or the hiring manager to onboarding and getting a new-hire up-to-speed.

- Productivity ramp-up cost — the cost associated with a new employee ramping up and learning the ropes. This is usually calculated based on a 60- to 90-day period where the new hire is doing more learning than producing. The new hire’s daily salary and benefits expense is often used here.

As an example, let’s do this for Company A, which is looking to fill an “average” experienced engineer role (not new hire). The company has a salary of $70,000 with benefits adding $15,000 for a total compensation of $85,000, or about $230 per day (the “trainer total compensation we will assume is about $110,000, or about $300 per day):

If it took 100 days to fill an average engineer position that equates to almost $85,000. Assuming a company with 50 engineers wanting to grow by 10% every year, the first five engineers recruited and hired would cost the company about $425,000! Can you imagine your company spending so much on a new technology without doing a thorough evaluation? But the requisite effort is precisely what is missing at many engineering firms when it comes to recruiting and hiring practices. And with a shrinking labor pool (due to Baby Boomer retirements and lower birth rates), finding talent will become even more difficult in the future.

At many engineering firms, those that get promoted to ownership levels are those that can bring in revenue (winning the work), typically taking a path of individual contributor engineer, project engineer, project manager and then principal. Revenue streams are such a key part of engineering consulting, but if an organization really wants to grow its leaders, managers need to make an intentional decision and dedicate resources in order to improve their sourcing (organizing or doing the work).

The first and most important step starts with a question: “Why would anyone want to work for ‘Manager X’ or ‘Leader Y?’” If you are managing others, why should anyone want to work for you? Are you cultivating your personal leadership/management brand as much as you are cultivating your brand to your clients? Keeping in mind that, per surveys, most employees leave their bosses. It is imperative that principals build their reputation within the industry as someone who is great to work for and then make sure the word gets out.

From my observation within engineering consulting, I rarely see it. Most of what the visuals show me is engineering consultants celebrate their project or proposal victories with hardly any effort in celebrating or promoting management successes. This could be done in the form of LinkedIn recommendations given and received by staff or blog posts highlighting the positive effect leaders have had on staff, among others. I believe the companies or those individuals that do dedicate the resources to building their manager reputation, especially those that do it first, will position themselves and their firms very well for our uncertain future. While building that manager reputation, the next steps can be started simultaneously. More on that next month.