PM Engineer did a quick spot check with PVF manufacturers to get their take on current market trends, industry challenges and what to expect in 2022.

According to Tom LaGuardia, vice president of sales and marketing for Milwaukee Valve and Hammond Valve, the companies are coming off a fantastic year and are poised for more success in 2022.

“Honestly, we didn’t forecast this rate of growth, so it was and remains a bit of a surprise,” LaGuardia says. “Coming out of the 2020 shutdown, there was quite a bit of pent-up demand. Milwaukee Valve was fortunate in that we continued our production at pre-shutdown forecasts, both domestically and in our overseas manufacturing facilities. Because of our inventory levels, we were able to satisfy orders as things began to open. And while we were burning through our inventories, we kept a foot on the gas in terms of production. Of course, we have experienced some of the same delays as just about every other business, but our delays seem to be shorter and order fill rates are not out of whack with what customers are experiencing from other segments of their businesses.”

In terms of trends, Ashley Martin, executive vice president of NIBCO, notes the big three are energy efficiency and sustainability, health and safety and ease of installation and serviceability. Comfort, convenience and connectivity also play a large role.

“There is a greater concern about the impacts plumbing and related systems and products have on the environment in terms of global warming,” Martin explains. “There is also more of focus on water-related personal safety and health risks. Additionally, the labor shortage accounts for the increasing need for products that are easier to install and service. Lastly, more people are spending time at home and investing in and upgrading their homes with Wi-Fi-enabled and digitally connected products as well as leak detection and water loss mitigation technologies.”

“There is a greater concern about the impacts plumbing and related systems and products have on the environment in terms of global warming,” Martin explains. “There is also more of focus on water-related personal safety and health risks. Additionally, the labor shortage accounts for the increasing need for products that are easier to install and service. Lastly, more people are spending time at home and investing in and upgrading their homes with Wi-Fi-enabled and digitally connected products as well as leak detection and water loss mitigation technologies.”

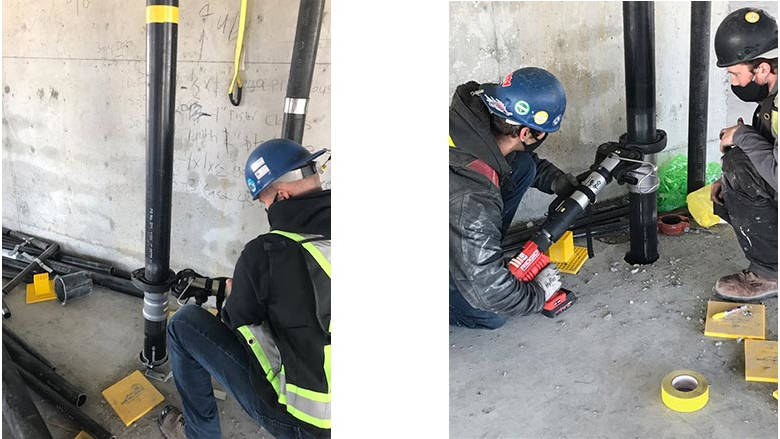

Bo DeAngelo, manager of technical training for Viega, notes that the market is all about finding ways to become more efficient, whether that is with press technology, pre-fabrication or automation.

“Labor shortages are driving all industries, regardless of type, to look at ways to increase efficiency or utilization rates,” he says. “The plumbing and mechanical industry is especially short on skilled labor and long on projects and service demands. The faster you can mobilize, get in, complete work and get back out, the sooner you can muster to the next project. The industry is seeing fewer battles over price, and more ‘When can you start?’ In today’s market, the winners will be those that know their numbers and rates of efficiency and use them to their advantage. Risk mitigation has never been more critical; products that offer speed and versatility coupled with higher reliability are going to be in high demand.”

The pandemic also brought a demand for more of an online experience, according to Amy Zucchi-Justice, director of marketing for Matco-Norca.

“COVID-19 accelerated the industry needing to get on board with e-commerce and self-serving portals,” Zucchi-Justice explains. “In the past, many of our sales teams and rep agencies didn’t need to log in to our website to access their customer’s order and purchasing information. They would pick up the phone or send an email. Now, people want to have more information available to them online.”

Matco-Norca is also providing its customers and industry at large with installation and demo videos.

“This is especially important with events still not coming back as strong as they were in pre-COVID days,” Zucchi-Justice says. People were forced into doing more online and pushed out of their comfort zones. Also, with so many Gen Xers retiring due to COVID, a younger generation is coming into the industry and doing things differently.”

Unstable market will continue to impact supply chain, material costs

Unfortunately, industry experts predict current supply chain shortages and rising material costs to continue well into 2022, if not beyond. However, it’s not all doom and gloom.

“It’s a safe assumption that we will continue to see an unstable market that will drive continued challenges in 2022,” says Chris Sellner, director of strategic sourcing for Uponor North America. “That said, our team continually communicates with our suppliers, vendors and customers to ensure cost adjustments are justified and warranted. We’re not alone in mitigating the material cost constraints, so the key is to make sure we’re all on the same page.”

Sellner notes Uponor continues to work with its suppliers for alternative ways to improve efficiencies and manage challenges.

“Reviewing our procurement processes, where we purchase goods and what forms of transportation are used to get our raw materials on site has always been important,” he says. “However, the last couple of years have taught us to be even more judicious in our sourcing practices. The benefits of this continual improvement have made our procurement more efficient, more effective and will enable us to weather any challenges that may come up in the future.”

Zucchi-Justice agrees, saying supply chain issues will remain high, which will, in turn, continue to keep costs up.

“Domestically, there is still a backlog of containers at rail yards and at the ports which continues to result in product shortages,” she says. “The delays of a shipment door-to-door are the highest we have seen to date. We still have truck driver shortages and facilities remain understaffed. While it seems COVID-19 is easing a bit, it’s an unknown as far as what will happen next and how long it will take to get back on track when COVID is controlled (for good). We are heading into the warmer months, which has calmed COVID spikes in the past, but what will happen in the fall and winter of 2022? No one knows.”

Zucchi-Justice explains that Matco-Norca has been working in this environment long enough to know what to do.

“We’re increasing a safety stock of inventory and expediting having critical products stocked at our warehouses that we know we need,” she says. “With SVF, we are using air freight when we can. And we are adjusting to the new norm with lead times. If we know we can get something quickly, we don’t worry as much as we do with items that are now taking 120 days. So we focus on that. We are also adding to our team to provide a better customer experience for customers. Everyone knows product shipments are delayed, but if you can handle it better, that helps.”

Additionally, the company tries to get in front of price increases early and continues to pay close attention to raw material costs, watching market trends and discussing issues as a team weekly so it can react quickly,” Zucchi-Justice notes. “It is still a booming industry, and, at some point inventory will improve and supply chain issues will go away.”

LaGuardia points out that people cannot watch the evening news and not see video and photos of container ships sitting off the major shipping centers and not understand the reality of the situation.

“Copper has climbed steeply — one year ago, copper was at $2.60/oz. and bottomed out at $2.17/oz. a month later,” he notes. “Currently, copper is at $4.46/oz., and was as high as $4.75/oz. in early May. And shipping and material costs are just two aspects of the many things affecting the market. No manufacturer can be expected to simply absorb these increased expenses. Since the beginning of 2020, we have passed through four price increases. And like just about everyone else, we face labor challenges.”

LaGuardia notes, however, that the people handling Milwaukee Valve’s logistics and shipping are outstanding.

“We contract for our containers for an entire year to guarantee availability,” he says. “We’re not filling containers as we go or spot-buying containers to satisfy urgencies. Pre-COVID, we were running at about 30 days to fill an order. In the depths of the shutdown, we were pushed out to about 60 days. While not ideal, at 60 days were can still manage the situation and adjust production schedules accordingly.

“One of the best things about Milwaukee Valve is that we control our own destiny,” LaGuardia adds. “We have a bronze foundry in Prairie du Sac, Wisconsin, and two wholly-owned factories overseas. Because they are wholly-owned, those facilities have only one customer — Milwaukee Valve. Occasionally, we can run into logistics challenges, but we are almost never out of our “A” products. We can adjust our production as needed. We are not dependent on shipments from others in that regard.”

Martin definitely sees rising material costs and supply chain disruptions continuing throughout 2022, largely due to the fact that supply is not able to keep up with demand; high inflation; raw material, energy, fuel and labor costs; and continued logistical delays triggered by the pandemic which require time to work through and resolve.

“NIBCO is dedicated to keeping our associates and their work environments as safe as possible,” Martin says. “We are recruiting and hiring additional associates, building additional inventory as quickly as possible, working with key supply partners to improve service and plan around longer lead times and communicating with customers and managing expectations accordingly regarding availability.”

Paige Riddle, director of sales strategy, Viega, notes there is great speculation of when the supply chain disruption will end.

“The issue is systemic, like a spoked wheel,” she says. “Break a few spokes and you start to wobble, break a few more and you are down to the hub. The economy is no different; those that missed the basics of supply and demand are getting a crash course. Producers that can hedge volume purchases, maintain quality over sacrificing for demand, and focus on customer service within the framework of what they can control will certainly hold an edge for those companies.

“Viega is committed to our customers and seeing them succeed,” Riddle adds. “Our supply chain and manufacturing teams work tirelessly to manage volume and ensure that we have what we need to produce. Couple that with Viega’s strategic nature and we have been able to navigate many of these challenges. We still face the same supply issues as others do, but we put the customer first and that has served us well.”

2022 market outlook

With the changes in work conditions following the pandemic, manufacturers have limited opportunities to be in front of engineers and contractors, LaGuardia notes. Therefore, the industry is shifting to include more online education opportunities.

“We strive to make the most of these changes,” he says. “For instance, the offices for some engineering firms have been shut down since March of 2020. Many new hires have only worked from home. We think these young engineers are missing the guidance and direction that their more senior supervisors can provide, even when it’s just the office banter and the opportunity to see how things are done and what questions need to be asked and answered. In addition, boomer-aged engineers are retiring and taking decades of experience and knowledge with them.

“At Milwaukee Valve, we strive to provide whatever support we can to help with that knowledge gap,” LaGaurdia continues. “We conducted seven webinars in 2021, many which qualified for ASPE continuing education credits. We issue a weekly newsletter with a focus on solutions to valve installation challenges, system design, standards and feature benefits that can simplify the work lives of our contractors and engineers, and not just on promoting our own brand.”

Martin expects to see continued strong demand in the market in 2022.

“There will also be more product innovation from manufacturers like NIBCO and Webstone,” she says. “Value-added product solutions will be the expectation moving forward.”

DeAngelo notes that there will be an increase in everything from jobsite automation to products driving speed and efficiency.

“The industry has to figure out how to do more in less time, and that will be the challenge moving forward,” he says. “Water mains used to be made out of barrel staves and steel bands, installed in hand-dug trenches and assembled by sinewy workers pulling equipment in horse-drawn carriages. Today we can run piping underground without a trench in many cases. Expect the current challenges illustrated above to create new opportunities for innovation and improvements on how we go to work. History does repeat itself.”

DeAngelo adds that piping companies not moving to new joining technology like press systems are missing out on a tremendous opportunity. “Whether you are the building owner, contractor or engineer, all benefit from proven technology that increases efficiency — on every aspect of the job from infrastructure to elevation. You can’t control the supply chain or raw costs. You can control your pricing and efficiency.”